Growing up, I always believed that getting a credits card and debt were bad. Don’t make any debt, and if I do, keep it small was my rule when I started working in my early 20s. This was because of my lack of knowledge and experience. Coming from a working-class family, I could see the effects debt had on our livelihood. This greatly affected my relationship with money and debt. Needless to say, my view of debt, credit cards and loans were negative and distorted. Like with everything in life, all things have two sides. So here are the good, bad and ugly of credit cards.

What is a Credit Card?

A credit card is a preapproved line of short-term credit. It allows the account holder to use the line of credit without using personal funds. You can use, repay and reuse the credit card within the credit card limit. Like loans, it has an interest rate and an insurance option. You can pay the minimum monthly instalment but I strongly discourage this. As minimum monthly payments have no upside for you as the consumer. To understand why you need to understand how the following work and affect each other:

- Credit card limits

- Interest-free period

- Interest

- Insurance

- Credit score

- Rewards

Credit Card Limit

A credit card limit is the hard limit that you can spend on a line of credit. Not the same thing as the offered amount. When applying for credit the financial institution will do an affordability check. The offered amount is based on the information you provide during the check. It will be on what you, the consumer, can afford in monthly instalments. They won’t take into consideration what you can pay in full monthly. Understanding the difference is very important. As the amount of credit will almost always be an amount that leaves you as much indebted to the institution as possible.

Instalments are minimum payments and not paying the account in full.

What most people don’t realise is that you can choose the amount of credit you take on. No one can pressure you into taking a credit card a few times your salary. No matter how attractive that sounds you need to check your finances before applying. Do an affordability check and determine what you can afford. That means you need to do a comprehensive budget to calculate your fixed and variable expenses, wants, needs and income. Once you know your financial situation you can calculate how much you can afford. Including what that would mean for your quality of life.

This is a very important step in managing your credit card. As it’s in your best interest to choose a credit amount that you can afford to pay in full every month. To reduce the interest you pay and increase your peace of mind. You should ask yourself “what amount of credit can I afford comfortably?” before applying for a credit card. If you have a high credit card limit you can reduce it systematically to limit the effects on your credit score.

Interest-Free Period

Most credit cards have an interest-free period. The length of the interest-free period depends on the financial institution and the standard is 55 days interest-free. The interest-free period is calculated from the date of the purchase. This means if you pay your credit card in full every month you will never pay any interest on that account. Effectively saving you that money that would otherwise be spent on interest. Some transactions types are excluded from the interest-free period but this differs from bank to bank. Transactions like:

- Withdrawals (ATMs)

- Transfers (inter-account and EFTs, money transfers, beneficiaries payments)

- Gambling (Casinos and Lotto)

- Petrol

The opposite is much more gruesome financially. If you never pay your credit card in full you are paying interest on old purchases and the interest-free period never reset. You have 55 days from the date of purchase to make payment and interest will start to accumulate from the 56 days until paid in full.

Interest

Interest is calculated on a personal basis as many factors are considered when calculating your personal interest rate. But, credit cards are considered high-interest debt like loans, clothing accounts, etc. Which easily falls under consumer debt and if mismanaged is bad debt. With any spend on a credit card you only pay interest on the money spent after the interest-free period lapsed. This also means that you can earn interest on a credit card.

This is not the best way to save money as the account is not set up to maximize interest gained but rather interest incurred. How you use this information is that you make the money you’re where already going to spend on food, petrol, entertainment, etc, work for you. Paying your credit card in full and putting your shopping expenses into the account will protect those transactions. Aid in the earning of interest and protect your hard-earned cash with card insurance. Never put all your money in a credit card account only the money you plan on spending.

Not so Fun Fact!

Only 15% of credit cardholders in South Africa pay their accounts in full every month. The remaining 85% are paying interest and never benefit from the interest-free period.

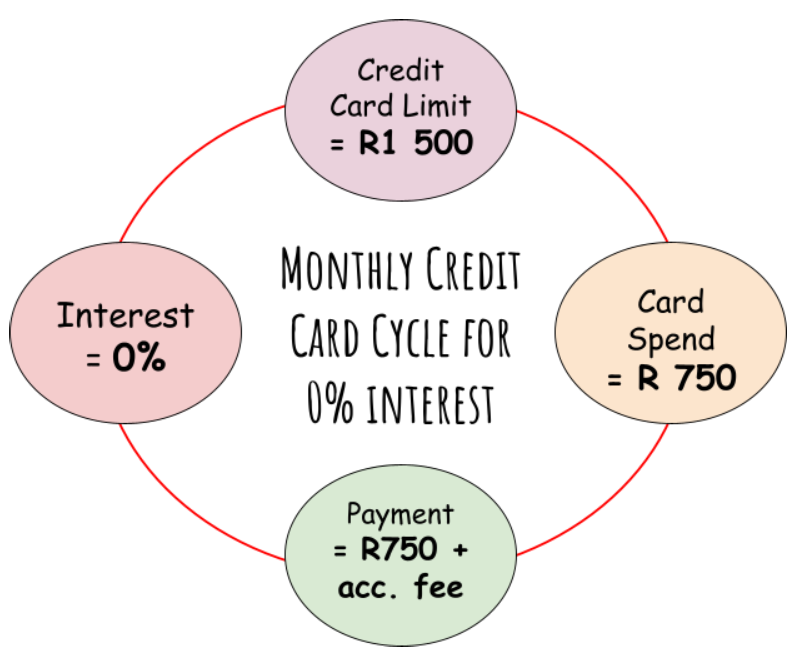

Here is how to manage your credit card monthly for 0% interest. Consider the red circle a chain and any break in the chain will result in interest payments the following month.

“As a rule of thumb always pay your credit card in full every month and you will pay no interest.”

Insurance

Credit card insurance protects your credit account against any unforeseen event. It protects the account holder against retrenchment, disability, dread disease or death. But, it also protects against fraudulent activity that happens on that account. Meaning you are protected for any purchases you make with your credit card or any potential fraud that might occur. Debit and savings cards don’t offer this option. Always say yes to insurance.

Furthermore, credit cards allow you to dispute any transactions for services or goods not received but paid for with a credit card. Anything you ordered online but, was not delivered. After disputing it with the company and they offer no resolution. You can dispute it with your financial institution.

Credit Score Impact

All credit, no matter the type, affects your credit score negatively or positively. How it affects your credit score greatly depends on how you use and repay the line of credit. Paying your credit card in full doesn’t just save money on interest but it will increase your credit score. That is if you have constant transactions happening on your credit account.

If you pay the minimum payment monthly it negatively affects your credit score. This happens when you have a credit card/s greater than what you can afford. You must at all times keep a minimum of 35% value of the card limit to not negatively affect your credit score. For more information on this check out my article “The hidden mystery behind your credit score“.

With a reduced credit score, you are unable to make big credit purchases. Purchases like property and vehicles including small credit purchases like clothing accounts, etc.

Rewards

Many credit cards have rewards programs. Some are optional at a fee and some are free. They range from points to cash rewards systems. When considering getting a credit card get one where the rewards program matches your lifestyle. However, owning many credit cards is never a good idea for rewards programs. Owning a credit card requires discipline and a great understanding of one’s financial situation to be able to use it to its full potential.

For example: if you travel often AmericanExpress might be a good option or if you use Sasol and Dischem monthly Absa might be a good choice. Always attempt to maximise your benefits as you don’t have to bank at an institution to get a credit card at the institution. Many financial institutions that aren’t banks also offer credit cards like Discovery, RCS, etc.

My first Credit Card

As mentioned above I had a grim view of debt and credit in general. This changed after I got my first credit card when I was 21. I decided that I can only afford an R1500 line of credit even though they offered me a ridiculous amount. To me, that was the scariest thing I could have done at the time. Take the amount they offered me. Still, this is a scary thought to be that indebted on credit cards and not good debt.

The reason I decided to get an R1500 card limit is that if I decided I didn’t want the credit card anymore I could pay it all at once. Ensuring I am not indebted to the bank if I don’t need to be. At the time I didn’t know that taking credit you can pay off in one payment is the correct way for short-term debt. I am so grateful to my younger self for this. This was a needed lesson at the time and it taught me that I am in charge of my finances and responsible for my financial future. That R1500 changed how I viewed debt and credit but also made me understand that I have more control over any future debt.

It’s that very credit card that ensured I had a good credit score and that I have maintained to this day. Cause with the right information you can make a more informed decision. So before taking on any new debt make sure you are coming from an informed place.

Pros and Cons of having a credit card

Credit cards can be bad or good debt. Good debt is any debt that helps build wealth or increase your income. Bad debt is any debt that negatively affects your financial situation. Examples of bad debt are high or variable interest rates and goods that depreciate or lose value. Credit cards if mismanaged can easy be bad debt but if well managed good debt.

So let’s have a look at the pros and cons of credit cards and how to achieve little to no debt through credit cards.

Cons

- High-interest rates – Credit cards tend to have higher interest rates as it’s a revolving line of credit.

- Low repayment – Credit cards always display the minimum payment required. Paying the minimum amount negatively affects credit score and increases the repayment amount. This results in bad debt.

- Ease of gaining many lines of credit – With all financial institutions offering credit cards, it to easy to apply for and gain many credit cards. Too many credits cards lead to increased debt and reduced ability to pay an appropriate amount. An amount to positively affect your credit score.

- Ease of mismanagement – Because credit cards give access to “easy money” there is a misconception that you can spend it however you want. This leads to mismanagement of funds and creates financial pitfalls.

- False sense of security – When you first get your credit card it gives a sense of security that you have extra money but this is not true. Extra money is reworking your budget to tighten expenses, spending and increase your income. If you think of credit cards as your money you might have that false sense of security.

- Lowering of credit score – All notices, defaults, missed payments, etc, appear on your credit score and it’s updated monthly. Missing payments on a line of credit or applying for multiple lines of credit lowers your credit score.

- Blacklisted – You run the risk of being blacklisted if you are unable to pay your debt.

Pros

- Improved credit score – With any credit constant transactions and payments show you can manage and pay your bills. The better you manage your transactions the better it influences your credit score.

- Credit Insurance – Credit card insurance provides an extra layer of protection. For your line of credit and any purchases you make. This is true for online shopping purchases as well.

- Ease of gaining credit – As many financial institutions offer credit cards, you can shop around for the best benefits before applying. You don’t have to have an account with an institution to open a credit card account.

- Rewards programs – Most if not all credit cards have some form of rewards program. It’s a matter of choosing which suit your lifestyle best. As your lifestyle and needs change you can move your line of credit from one financial institution to another. With little effect on your credit score. Moving your line of credit to a more beneficial program is better than taking on multiple lines of credit.

- Ability to choose a credit limit – You can choose what amount of credit you wish to take on. Regardless of the amount that the financial institution offers. Granted the amount you want is not higher than the amount they are offering.

- Travel Insurance – When purchasing a flight with your credit you get a free 30 days of travel insurance. Some credit cards offer free travel lounge access. This differs from card to card.

Different financial institutions will offer different benefits. This affects what additional pros they will offer like the rewards programs. Offering cash backs, and combination plans at a reduced cost. Furthermore, you don’t have to use any of the credit and still enjoy the benefits of a credit card. By transferring money into the credit card and only spending your funds.

Should I get a credit card?

Too often I have seen people fall victim to the appeal of credit cards without understanding how they work and how to manage them. The biggest contributing factor to credit becoming a financial pitfall is that you live above your means on a line of credit.

Its cause and effect,

negative spending = negative financial habits = financial pitfall

Then the latter is also true,

positive spending = positive financial habits = financial freedom

Under which circumstances you fall greatly depends on your choices. My final pieces of advice on credit cards are:

- Ask questions

- Read the terms and conditions before signing

- Shop around and compare options, rewards, interest-free periods, price plans, etc.

- Speak to people you trust and professionals and/or on financial forums

- Only once you’ve chosen a credit provider to apply for the line of credit. Never at multiple places at the same time

- Remember bad debt affects your and your family’s quality of life

- Never spend more than you can pay in a single month

- Avoid impulsive buying on any line of credit

- Never miss a payment

- If your debt is too much arrange a payment plan with the bank on a fixed interest rate

It would be best to do a comprehensive financial analysis of your situation. Listing your assets and liabilities. Followed by consulting with a financial advisor before deciding if a credit card is the right choice for you. Don’t just listen to some random stranger on the internet. I know, I am a random stranger, but only you can answer the question if a credit card is right for you.

I hope this article has helped you with some information on how credit cards work to aid in your financial journey. If you have any questions or tips on credit cards post them in the comments section.

Leave a Reply